7 Signs You're Ready to Sell Your House

Should I sell my house? If you’ve been asking yourself this question lately, we’ve got good news: It’s a great market for sellers! Limited inventory continues to drive home prices up, and the latest data from the National Association of Realtors shows that nearly half of recently sold properties were on the market for less than a month.(1)

Of course, the decision to sell your house isn’t based solely on market conditions. You have to take your personal situation into account—and that’s where expert advice comes in handy.

Here are seven signs you’re ready to sell your house:

1. You’ve got equity on your side.

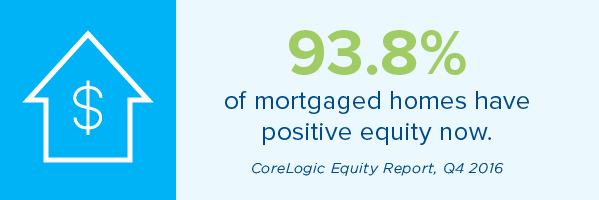

For most homeowners, being financially ready to sell your house comes down to one factor: equity. During the housing meltdown of 2008–09, millions of homeowners found themselves with negative equity, which meant they owed more on their homes than they were worth.

Clearly, selling your home when you have negative equity is a bad deal. That’s called a short sale. Breaking even on your home sale is better, but it’s still not ideal. If you’re in either situation, don’t sell unless you have to in order to avoid bankruptcy or foreclosure.

For the last several years, home values have been on the rise—by leaps and bounds in many cases—and that means most homeowners are building equity. Their homes are now worth more than they owe on them, and that trend will persist as they pay down their mortgages and home values continue to increase.

Figuring out how much equity you have may sound complicated, but the math is actually simple. Here’s how it works:

First, grab your latest mortgage statement and find your current mortgage balance.

Next, you’ll need to know your home value. While it’s tempting to use figures from online valuation sites to determine how much your home is worth, they’re not always accurate. Ask an experienced real estate agent to run a free comparative market analysis (CMA) for the best estimate.

Once you have those two numbers in hand, simply subtract your current mortgage balance from your home’s estimated market value. The difference will give you a good idea of how much equity you have to work with.